Looking for mobile personal loans in 2025? The best loan apps now offer instant loan approval, high security, and smooth user experience right from your phone. In this guide, we’ll explore the top-rated finance apps delivering fast cash and great terms.

Why Choose Mobile Loan Apps in 2025?

Mobile loan apps have revolutionized lending:

- 🌟 Instant loan approval—no waiting.

- Fully digital—no paperwork or bank visits.

- Personalized terms and repayment plans.

- Accessible for users with limited or poor credit history thanks to advanced underwriting.

According to Sensor Tower, global downloads of finance apps surged to 7.7 billion in 2024—showing trust in digital finance thetimes.co.uk+2uplinenews.com+2jploft.com+2sensortower.com.

How to Choose the Right App

Look out for these factors:

- Approval & funding speed

- Loan limits & interest rates

- Security & data privacy

- Repayment flexibility

- Credit score requirements

These criteria are emphasized in major reviews kashgain.net+6loanwisehq.com+6nobroker.in+6.

Top Instant Loan Apps in the U.S. (2025)

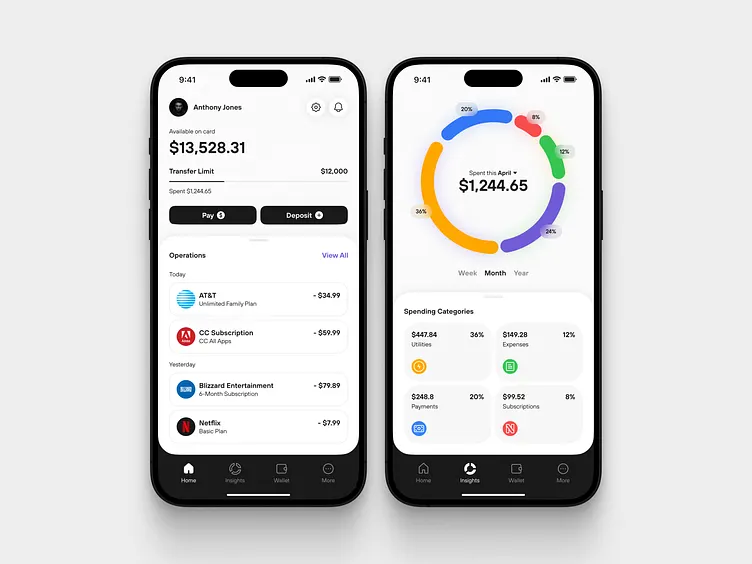

1. MoneyLion

- Instacash advances up to $500—no interest.

- Includes credit-building and investing features.

- Instant funding for members uplinenews.com+1forbes.com+1.

2. SoFi

- Borrow up to $100,000 with competitive APR from ~8.99%.

- No origination, late, or prepayment fees.

- Funds in 1–2 business days forbes.com+14uplinenews.com+14loanwisehq.com+14cleveroad.com+6loanwisehq.com+6thetimes.co.uk+6.

3. Upstart

- AI underwriting, considers education & employment history.

- Loan range $1,000–$50,000; funds often within 24 hours en.wikipedia.org+15uplinenews.com+15en.wikipedia.org+15.

4. Earnin

- Advance based on your paycheck; no fees or interest.

- Lightning-fast deposits livemint.com+3uplinenews.com+3loanwisehq.com+3.

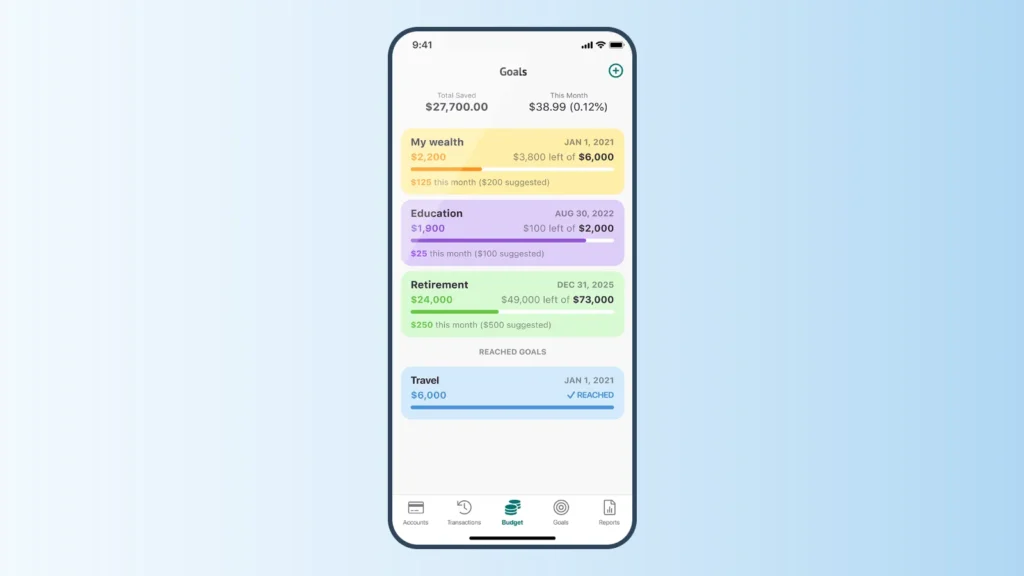

5. Brigit

- Up to $250 cash advances, with budgeting tools.

- No interest—monthly subscription applies ($8.99–14.99) loanwisehq.com+3uplinenews.com+3forbes.com+3.

6. SoLo Funds

- Peer-to-peer model, borrow up to $575 with no interest.

- Funds typically in ~20 min loanwisehq.com+2uplinenews.com+2forbes.com+2theappsolutions.com+2forbes.com+2loanwisehq.com+2.

7. Possible Finance

- Small loans ($500), helps build credit.

- Installment repayment reported to bureaus uplinenews.com.

8. LendingClub

- Peer-to-peer loans from $1,000–$40,000.

- Quick approval and funding livemint.com+4uplinenews.com+4loansfinance.in+4.

Top Global Instant Loan Apps (2025)

Tala

- Offers micro-loans in emerging markets.

- AI-based scoring; millions of global users loansfinance.in.

Branch

- Loans $10–$1,000 with instant approval.

- Strong presence in Nigeria, India, Mexico kashgain.netkonnect.com.ng+1ft.com+1.

FairMoney

- Loans $50–$1,500; funds in minutes.

- Expanding to savings and investment features kashgain.net.

mPokket (India)

- Loans ₹500–₹30,000; approval in ~10 min jobmxr.com+7livemint.com+7sarkarilist.com+7.

LazyPay / MoneyView / PhonePe (India)

- Instant personal loans via app; processing in minutes en.wikipedia.org+3nobroker.in+3livemint.com+3.

In-Depth App Profiles

MoneyLion

- Use case: Instant advances, credit-build tools, investing.

- Pros: No credit check for Instacash; integrated finance.

- Cons: May require subscription lvivity.com+15uplinenews.com+15loanwisehq.com+15.

Upstart

- Use case: Fair-credit borrowers seeking larger loans.

- Pros: AI-driven, fast, wide eligibility.

- Cons: Origination fee up to 8% uplinenews.comjobmxr.com.

Brigit

- Use case: Short-term safety net + budgeting support.

- Pros: No interest; financial tools included.

- Cons: Monthly subscription; low loan cap uplinenews.com.

SoLo Funds

- Use case: Quick cash via peer lending.

- Pros: No interest.

- Cons: Repayment within 35 days, optional tips loanwisehq.comuplinenews.com+2forbes.com+2loanwisehq.com+2.

Tips for Instant Loan Approval

- Pre-qualify via soft credit pulls – avoids hard inquiries.

- Provide documents in advance (ID, pay stubs).

- Use bank account login for instant verification.

- Apply during weekdays to speed processing.

- Check hidden costs—watch APR, origination fees, subscription charges.

Internal & External Resources

Internal:

External:

- Mint: 7 Instant Personal Loan Mobile Apps for 2025 uplinenews.cominvestopedia.com+2livemint.com+2sarkarilist.com+2

- Upline News: Top 10 Loan Apps in the USA 2025 uplinenews.com

- Forbes Advisor: Best Loan Apps for Cash Advances forbes.com

Final Verdict for 2025

| Scenario | Best App |

|---|---|

| Large loans, low APR | SoFi, Upstart |

| Short-term paycheck advances | Earnin, Brigit |

| Peer-to-peer, interest-free | SoLo Funds |

| All-in-one financial toolset | MoneyLion |

| Emerging markets, micro-loans | Tala, Branch, FairMoney |

These loan apps excel in instant approval, security, and tailored lending. Choose what aligns with your needs—emergency fund, building credit, or handling major expenses. Always understand the costs, repayment schedules, and data practices before applying.